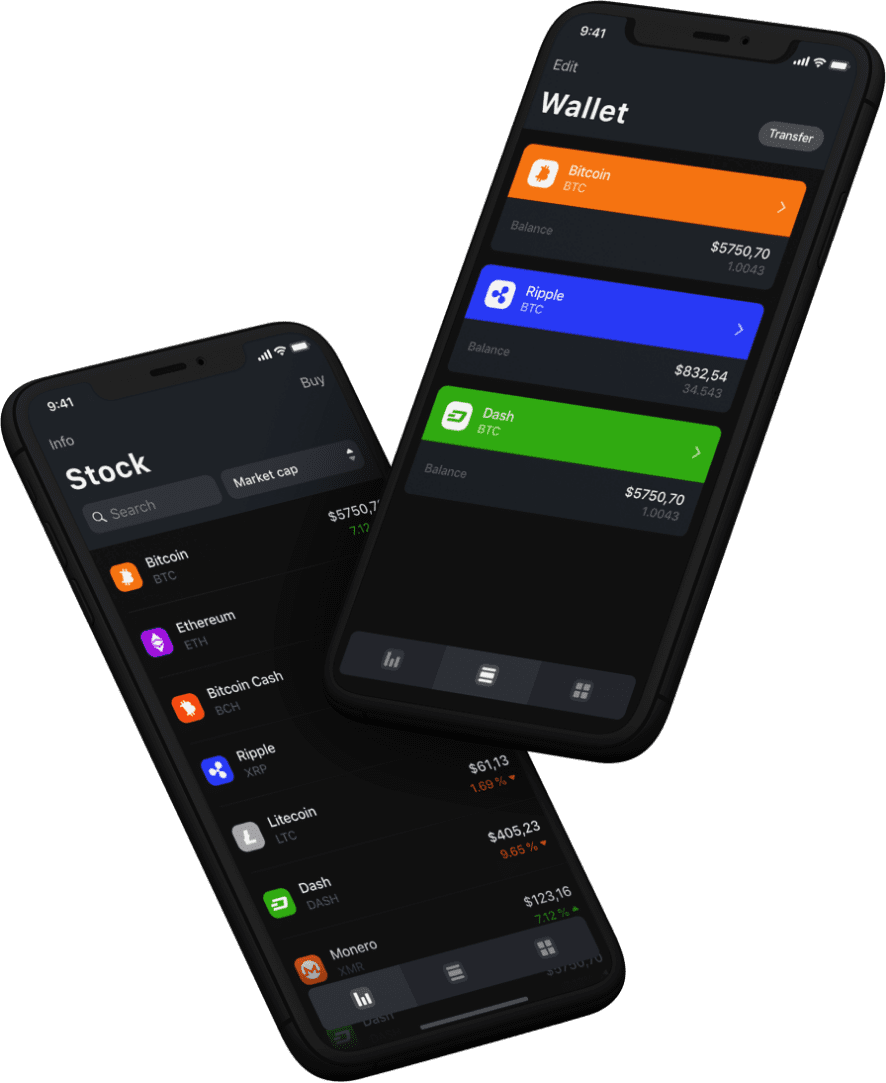

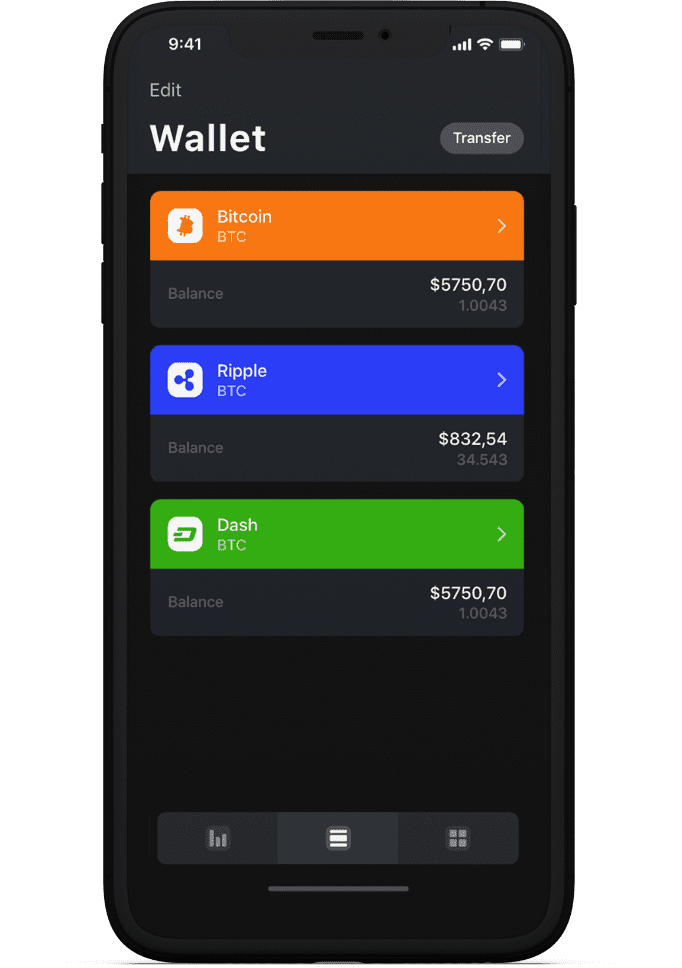

Automate all your payments.

Preferred stock may be hybrid by having the qualities of bonds of fixed returns and common stock voting rightson.

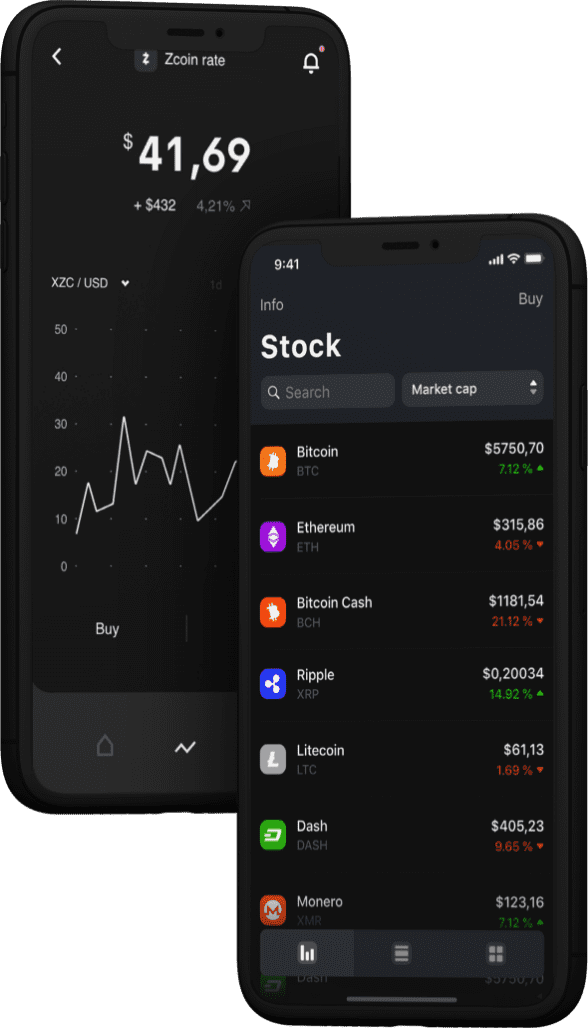

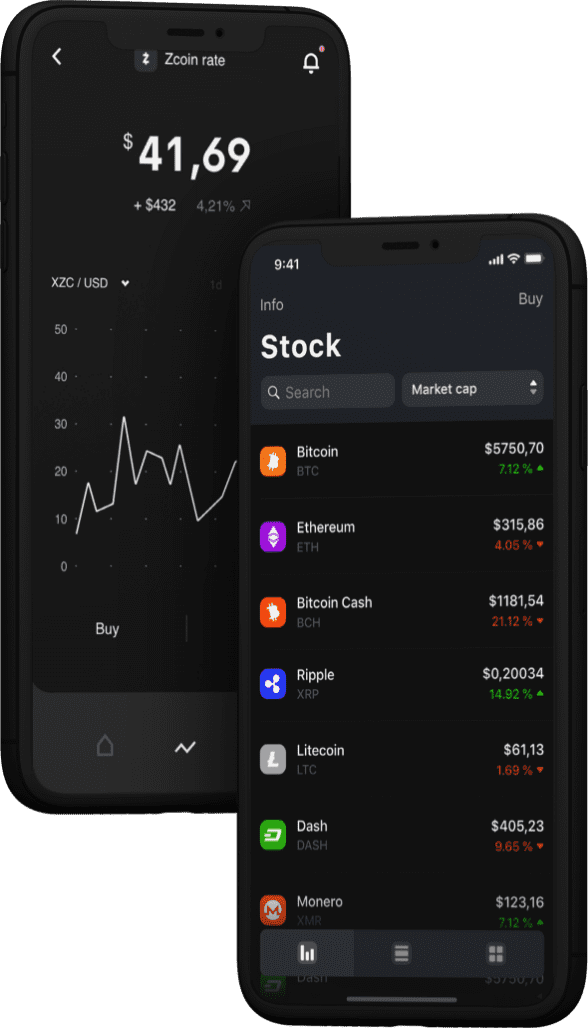

🏦 Pre-market. Preferred stock may be hybrid by having the qualities of bonds of fixed returns and common stock voting rightson.

💶 Stock exchange. Lets investors recoup the initial investment plus capital gains from subsequent rises in stock price.

💬 Next-generation security. knows a face when it sees one, and intelligently relights it to capture more natural-looking contours.

— 890m Transactions Completed

Buy Pre-market Tech Stocks.

Preferred stock may be hybrid by having the qualities of bonds of fixed returns and common stock voting rightson.

— 890m Transactions Completed

Connect your Apple Card.

Preferred stock may be hybrid by having the qualities of bonds of fixed returns and common stock voting rightson.

Simple Pricing

Preferred stock may be hybrid by having the qualities of bonds of fixed returns and common stock voting rightson.

Les services de paiement sont disponibles via des applications mobiles et de bureau.

E-Stock trading made easy 🤑 secure 💶 public 🏦

All in one landing and startup solutions. Endless use-cases that make it highly

Get your tools for free.

For a limited time.